The post Nepal, Bangladesh Agree to Jointly Invest in Nepal Hydropower appeared first on Nepali Sansar.

]]>The two countries’ energy secretaries decided to invest in 20 major hydropower projects including Dhudkoshi, 536 MW Sunkoshi III, 1,110 MW Sunkoshi II and Upper Arun hydropower projects.

Nepal Energy Secretary Dinesh Kumar Ghimire and Bangladesh Energy Secretary Abu Hena Md Rahamatul Muneem represented the two countries at the meeting.

The two countries also decided to hold discussions with India to export power from Nepal to Bangladesh using Indian electricity transmission lines through the Siliguri corridor.

The two nations also decided to collaborate on alternative energy, besides investing in hydropower projects and exporting electricity from Nepal to Bangladesh.

“We held discussions on enhancing energy trade and investment between the two countries,” said Ghimire, while sharing that the two nations also planned to build a new high-voltage transmission line to Bangladesh through India.

The given projects are an important part of Bangladesh’ policy to import 9,000 MW electricity from Nepal by 2040.

The JSC meeting is a follow-up to the meeting that marked the Nepal-Bangladesh agreement on energy cooperation ‘Cooperation in the Field of Power Sector’ held in August 2018 in Kathmandu.

As part of their first meeting, both nations agreed to cooperate on:

- Cross-border transmission lines

- Development of efficient human resources in the hydroelectric sector

- Development of hydroelectricity

- Grid Connectivity

- Investment in renewable energy

- Promotion of Government-to-government and private sector investment and more

The agreement comes at a time when Nepal’s power generation is expected to increase in the next fiscal year with the initiation of 43 projects hydropower projects of 1149 MW installed capacity.

According to an official who attended the meeting, the estimated annual cumulative output for the proposed projects is 42713.18 GW/hr, almost 12 times Nepal’s current total output per year.

The post Nepal, Bangladesh Agree to Jointly Invest in Nepal Hydropower appeared first on Nepali Sansar.

]]>The post India Relaxes Norms for Power Export from Nepal appeared first on Nepali Sansar.

]]>Along with the new guidelines on cross-border trading of electricity, the Indian Government added a new provision allowing power trade between any two countries using Indian power lines upon an agreement with the Indian Government’s Central Transmission Utility.

“Where tripartite agreement is signed for transaction across India, the participating entities shall sign a transmission agreement with the Central Transmission Utility of India to obtain transmission corridor access,” say the newly-issued Guidelines on Cross Border Trade Import/Export of Electricity.

Indian Government had failed to recognize the trilateral agreement while issuing guidelines on cross-border electricity trade for the first time in 2017.

Experts feel that the new guidelines replacing the old ones issued in 2017 will provide an opportunity for Bangladesh and Nepal to enjoy power trading through Indian territory.

“This will foster power trade between Nepal and Bangladesh, giving opportunity to the former to export surplus electricity that it is on the track to generate within a few years,” says Semana Dahal, a lawyer and also an advisor to the Government of Nepal on infrastructure projects.

Responding on India’s move, Nepal Energy Ministry Minister said that the new decision would also give due boost to Nepal’s hydropower sector.

“The new guidelines were introduced along with the spirit of the Power Trade Agreement (PTA) signed between Nepal and India in 2014 which requires both countries to allow non-discriminatory access to cross-border electricity market,” says Dinesh Kumar Ghimire, Joint Secretary at the Energy Ministry.

The Indian Government also removed older guidelines that allow India Government-owned Nepali-based hydropower projects (or those with majority Indian share) to export power only to India.

And, other companies open to selling power to India were mandated to receive approval of the designated authority on a case-by-case basis.

That move discouraged foreign investors and electricity exporting firms of Nepal keen on building export-oriented hydropower projects targeting the Indian market.

“The approval for export could be refused if the designated authority is not satisfied with equity ownership or Indian government does not concur as per the new guidelines. This leaves some room for discretion,” says Dahal.

Dahal argues that the guidelines lack precision and most of the matters in them will further need clarification in the regulations to be issued by the Central Electricity Authority (CEA) or Central Electricity Regulatory Commission (CERC) of India.

The post India Relaxes Norms for Power Export from Nepal appeared first on Nepali Sansar.

]]>The post Nepal Bags USD 100 Mn World Bank Grant for Energy Sector appeared first on Nepali Sansar.

]]>The grant under the Nepal Energy Sector Development Policy Credit program intends to support the country’s energy sector in effective implementation of related regulatory, policies and institutional measures.

The fund is going to play a key role in strengthening financial viability of the Nepal Electricity Authority (NEA) through the establishment of a regulatory framework that eases electricity trade and restructures NEA encouraging the private sector participation.

“The proposed credit aims to support the restructuring and market reform of the electricity sector to improve governance and performance of electricity institutions, eventually enhancing quality and efficiency in services,” World Bank Country Manager for Nepal Faris Hadad-Zervos said in a statement.

The World Bank’s move gains significance in view of the fact that Nepal is heavily dependent on electricity imports despite its high hydropower potential, to address the power shortage domestically.

This situation persists owing to the large number of yet-to-be-materialized hydropower projects in the country.

“The new credit aims to implement policy and institutional measures to overcome these challenges and help bring about structural reforms in the energy sector, to ensure affordable electricity services and encourage predictability for sustainable investment,” the World Bank release informed.

The World Bank is currently supporting 22 active investment projects in Nepal with USD 2.5 billion assured in commitment from the International Development Association.

With the first credit assistance in 1969 for a telecom project, the World Bank has so far offered

USD 4.75 billion in assistance to Nepal, with USD 3.48 billion in credits and USD 1.27 billion in grants.

The post Nepal Bags USD 100 Mn World Bank Grant for Energy Sector appeared first on Nepali Sansar.

]]>The post IFC Mulls Safe Investment Opportunities for Nepali Citizens appeared first on Nepali Sansar.

]]>The report entitled ‘Local Shares: An In-depth Examination of the Opportunities and Risks for Local Communities Seeking to Invest in Nepal’s Hydropower Projects’ analyzed the country’s innovative benefit sharing policy that allows communities’ investment in local hydropower projects in the form of ‘local shares’.

Currently, the Government of Nepal mandates hydropower developers to give 10 percent of their shares to communities affected by the project.

Considering the government’s goal of generating 10,000 MW hydropower in the next 10 years, around USD 439 million can be raised from project-affected communities as ‘equity’, says IFC.

Nepal’s local shares model is unique. It recognizes the importance of communities in private sector hydropower investment, says Wendy Werner, IFC Country Manager for Bangladesh, Bhutan, and Nepal.

“For example, in the last three years, over USD 10 million was raised through local shares by 13 small-to-medium hydropower companies. The investment model offers great potential to create local ownership and increase public support for hydropower projects,” adds IFC, a World Bank Group member.

However, IFC reports lack of awareness about the sharing market mechanism and safety measures that can reduce investor risk among locals, majorly women and socially, economically & culturally disadvantaged communities of the country.

The report found that locals borrow at high interest rates or sell primary assets in order to invest in local shares, ending up in unrealistic expectations and risk of loss.

To address such gaps, IFC recommends community-level education and enhanced regulations that can maximize investment opportunities and also protect them from undue risk.

The study also recommends simplification of financial information making it understandable event to non-subject matter experts, creation of low-risk mechanisms for vulnerable households, digitizing the share allocation process and information online for more transparency and accountability in the process.

“IFC aims to ensure the private sector contributes to sustainable power development and that this investment opportunity is within reach of every citizen, balancing the potential returns with the project risks,” adds Werner.

“The comprehensive consolidation of this report is very timely and will hopefully enable informed discussions at the policy level to improve and strengthen the local shares mechanism as a viable model of equity participation involving local people,” says Kulman Ghising, Managing Director of Nepal Electricity Authority.

Also Read:

- Nepal 2017 Highlights: Hydropower Potential Grows Three-fold with 16 New Projects

- Himalayan Hydro Expo 2018: Investors Urged to Tap Nepal’s Hydropower Potential

- Nepal For Clean Energy Solutions, Bets Big on Hydropower

The post IFC Mulls Safe Investment Opportunities for Nepali Citizens appeared first on Nepali Sansar.

]]>The post Morang District Benefits with Solar Mini-Grid Project appeared first on Nepali Sansar.

]]>Besides this, nearly 75 houses in Aitabare area received electrification, prior to which residents suffered in the absence of a central transmission line.

The project was funded by the Asian Development Bank, Alternative Energy Promotion Centre and the District Coordination Committee who contributed Rs 14.5 million, Rs 1.6 million and 600,000, respectively.

Speaking at the inaugural ceremony, Energy, Water Resource and Irrigation Minister Barsaman Pun said that the distant areas which do not have access to the central transmission line will be put in touch with solar energy.

Pun also added that the Nepal Government has put supply of drinking water and irrigation facilities on top priority.

Talking about future plans, he said that the formation of the Federal Government has paved way for energy tie-ups with China and Bangladesh.

There are many hydropower and renewable energy projects that are already initiated with small and large scale firms in Province 1.

Member of National Planning Commission Dr Krishna Prasad Oli, Executive Director of Centre Nabaraj Dhakal and Member of House of Representatives Ghanshyam Khatiwada, also shared their views on development prospects with the help of solar energy.

Conclusion:

It is said that big changes begins with a small step. We hope that projects such as these pave the way for the overall development of Nepal.

The post Morang District Benefits with Solar Mini-Grid Project appeared first on Nepali Sansar.

]]>The post HIDCL New Scheme to Attract More Public Investments appeared first on Nepali Sansar.

]]>Following Energy Minister Barsha Man Pun’s directions, the state-owned Hydro-electricity Investment and Development Company Limited (HIDCL) created the scheme to welcome maximum people’s participation in the development of these government projects.

According to the scheme, people can now buy shares by paying 10 percent of the original cost at the initial public offering. The remaining amount can be paid in a 50:40 ratio where 50 percent will be paid prior to 80% of construction progress and 40 percent has to be paid when the project is almost due for completion.

“If the public is allowed to make investments this way, the financial burden will be less, and a larger section of the population can invest in such projects. Also, the people will feel that their investment is secure as they will be making payments in installments based on the progress of construction works,” Therefore, we came up with this scheme,” says Chhabi Raj Pokharel HIDCL CEO.

In the meantime, HIDCL has shortlisted 19 government-owned projects that need public investments including 725 MW Upper Arun, 450 MW Kimathanka Arun, 101 MW Tamakoshi-5 and 48 MW Bheri Babai Diversion Multipurpose projects.

The post HIDCL New Scheme to Attract More Public Investments appeared first on Nepali Sansar.

]]>The post Investment Pouring in for Nepal’s Arun III Hydropower Project appeared first on Nepali Sansar.

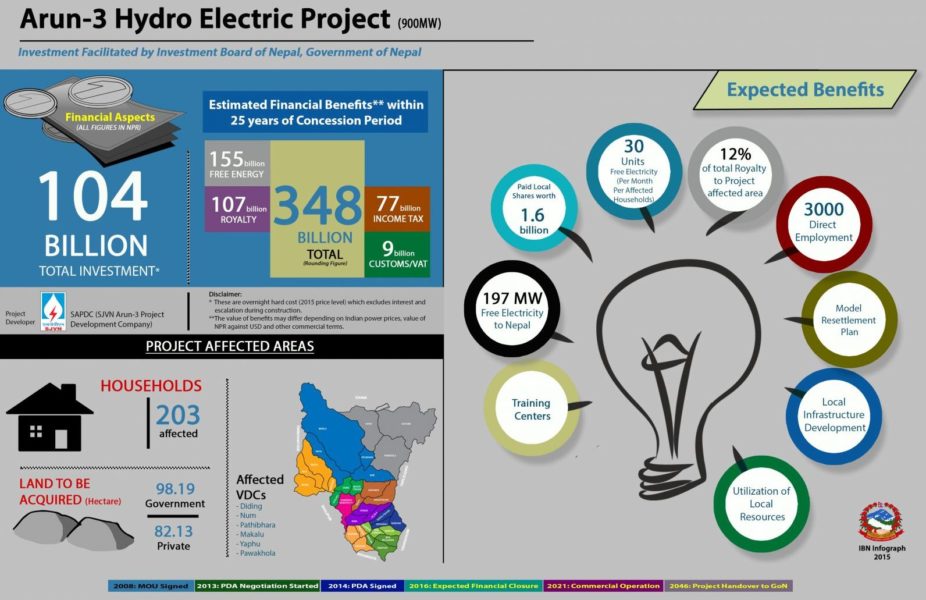

]]>The 900-MW capacitive Arun III hydropower project, to be built on Nepal’s Arun River, is drawing a huge investment from a wide variety of organizations belonging to the banking and financial services sectors.

In a recent move, India’s banking giant State Bank of India (SBI) announced its INR 80 billion investment for the project.

SJVN Limited and SBI entered into an informal agreement in this regard considering this investment as loan for the project. SJVN is the Indian PSU taking up the project construction.

“The Director Committee Meeting of the bank is due to make the recommendation. They soon will decide over. As of now they have decided over the loan extend and the interest rate over it has been finalized. The Rs. 1.4 trillion over the project will be expended for the construction of the structures and additional Rs. 11 billion for the transmission lines,” reads a statement by a source.

According to the sources, the Everest Bank Limited (EBL) and Punjab National Bank (PNB) are also investing in this prestigious project. “EBL will also invest INR 2.25 billion in the Arun III project,” the source added, while PNB’s investment stands at INR 5 billion.

This project, upon completion, will provide Nepal with 21.9 percent of the total electricity produced in a year, which equals to 197 MW, with 86 crore free units annually.

Besides, Nepali banks are also likely to offer Rs 4.06 billion as a bridge loan for the project.

Apart from the banking sector, the Government of India has already approved a sum of Rs 92 billion to be invested by SJVN.

With its total Rs 25 billion investment, SJVN will take the complete charge of the project for 25 years period excluding the construction time.

Post the finalization of investment, the Investment Board of Nepal will issue the license for the project.

“The Nepal Investment Board will soon issue the license for the construction of the project. It will not take more than a month meaning the license will be granted by mid-June as of now,” said an official representing the Board.

The Prime Ministers of India and Nepal, Khadga Prasad Oli and Narendra Modi, have recently laid foundation stone for Arun III hydropower project that is expected to be completed by September 2022.

The post Investment Pouring in for Nepal’s Arun III Hydropower Project appeared first on Nepali Sansar.

]]>The post Nepal Power Investment Summit 2018: Potential and Investment Discussed appeared first on Nepali Sansar.

]]>The second edition of the three-day Nepal Power Investment Summit 2018, held during January 27-29, 2018, saw the participation of renowned personalities from international bodies such as SAARC, BIMSTEC and ASEAN, global leaders and investors, ambassadors, bankers, ministers and businessmen, among various other key delegates from different parts of the world.

A total of 350 delegates from 24 countries including China, Korea, Europe and the United States, around 100 participants representing 30 international companies and around 400 participants from Nepal including policymakers and private sector players took part in the summit.

As part of the summit, various government and industry experts expressed their views on Nepal’s energy sector and its potential.

President Calls for Energy Investment

Inaugurating the summit on January 27, 2018, President Bidya Devi Bhandari called on the global and local investors to tap the untapped hydropower potential of Nepal.

“We need capital and technology for the implementation of large scale hydropower projects and the government will accord top priority to attract foreign investment and technology. The investors will also benefit from the growing demand for electricity in Nepal as well as South Asia,” said the President in her inaugural address.

In this regard, she promised an investor-friendly environment in line with their interests and needs to all the players coming forward.

Need to Act Fast, says Ambassador

Highlighting Nepal’s strong energy potential, Indian Ambassador to Nepal Manjeev Singh Puri said the country should act fast in implementing the hydropower projects considering the inclination towards renewable energy projects at the global-level.

“In the backdrop where solar power is getting cheaper day by day, hydropower will lose its competitive advantage to solar energy soon. Therefore, Nepal should act fast in developing the hydropower projects,” said Puri in his keynote address.

He went on to say that Nepal should start mega energy projects for both employment generation and economic development and to stay ahead in competition.

“Nepal should immediately start developing large projects to provide energy at competitive rates,” he added.

Industry Experts Seek Faster Implementation

Though Nepal’s energy policies for foreign investors look promising, the government agencies working in the process need to pace up the rate at which they implement the projects, say the energy industry experts.

“We are the private sector who looks maximized return within short period of time, but here in Nepal we have to invest more than five years doing basic things, getting approvals and clearances,” said a Vietnam-based businessman who participated in the summit.

The experts also lauded the Government of Nepal’s power purchasing policies in USD term, ease in removal of land ceiling for big hydro projects and management of technical human resources as some of the notable developments required for attracting foreign investment.

Innovation in Investment

Speaking at a panel discussion on ‘FDI in Nepal’s Power Sector’ held as part of the summit, various energy industry experts and investors called for innovative ways of financing in the Nepali hydropower sector.

“Since hydropower projects are capital intensive and have longer gestation period, innovative financing solutions like equity financing is the need of time,” says a Nepal-based private industry player.

The panel speakers also pitched for independent regulatory body to check the demand and supply along with fixing energy tariff in the country.

Towards Energy Development and Expansion

According to the summit organizer, Energy Development Council (EDC), this summit is aimed at creating a platform to ensure one-step business and business expansion in the energy sector while matching the interests of industry players.

The summit was hosted a participant-investor platform allowing participants to meet investors for a debt financing of around

USD 5-20 billion for various power projects including solar, wind and hydro energy.

Speaking on the occasion, EDC Chairperson Sujit Acharya highlighted that Nepal holds a 40,000MW electricity generation potential over the next 10 years.

“The resources needed for harnessing hydropower to that level could be available from the international financing institutions under Engineering, Procurement, Construction and Financing modality,” he added.

The post Nepal Power Investment Summit 2018: Potential and Investment Discussed appeared first on Nepali Sansar.

]]>The post Abundant Hydropower Potential appeared first on Nepali Sansar.

]]>The country’s hydropower potential is estimated at 85,000 MW with 43,000 MW being economically-viable.

The country is currently having a installed hydropower capacity of 752 MW and rivers are the only source of the plants operating in the country.

The electricity demand in the country is growing at an annual rate of 28%. 92 percent of the country’s energy needs are met by the hydropower sector.

Interestingly, 2001 alone saw over 100 hydropower project proposals in Nepal. Nepal’s first hydro power plant was built in Pharping with the support of the United Kingdom.

The post Abundant Hydropower Potential appeared first on Nepali Sansar.

]]>The post Nepal Holds USD 46 Bn Investment Potential for 2030 appeared first on Nepali Sansar.

]]>The International Finance Corporation’s (IFC) report titled ‘Climate Investment Opportunities in South Asia’, released last week, said Nepal holds USD 46.1 billion worth investment potential and would also fulfil its national climate targets promised under the Paris Agreement by 2030.

According to the report, Nepal offers such opportunities in key sectors such as transport infrastructure, renewable energy and municipal solid waste for the 2008-13 period as part of its moves towards achieving climate change targets.

IFC’s assessment was based on Nepal’s commitment under Nationally Determined Contributions (NDC) to the United Nations Framework Convention on Climate Change in October 2016.

Hydropower and Solar Energy, Among Others

In its NDC, Nepal promised generation and distribution of 12,000 MW hydroelectricity and 2,100 MW solar energy, better waste management and control of methane emission, while also equipping every rural household with smokeless cooking stoves by 2030.

Meeting all these requirements would mean almost USD 46.1 billion investment with 12,000 MW hydropower generation alone requiring USD 22.5 billion investment, says the report.

Besides, the Nepali Government’s policy to integrate technological solutions in the country’s agricultural sector would need another USD 4.8 billion.

Private Sector Participation

While highlighting the role of private sector, IFC called on the Government of Nepal to facilitate private-public partnerships and also conduct awareness programs on climate smart-projects to understand the financial benefits of investing in green projects.

The report also recommended revision of foreign ownership limits, restrictions on non-equity investments and sector caps for attracting foreign investment.

Overall, the South Asian countries, which contribute to seven percent of global CO2 emissions, hold USD 3.4 trillion climate-smart investment opportunities to fulfil their national targets, highlights the report.

“The only way that the South Asian countries can take advantage of these climate investment opportunities is with a strong and engaged private sector,” says Philippe Le Houérou, CEO, IFC.

The post Nepal Holds USD 46 Bn Investment Potential for 2030 appeared first on Nepali Sansar.

]]>